Hi everyone, this is Min and I am writing this posting to explain " the comparison between expected utility of wealth and utility of expected wealth."

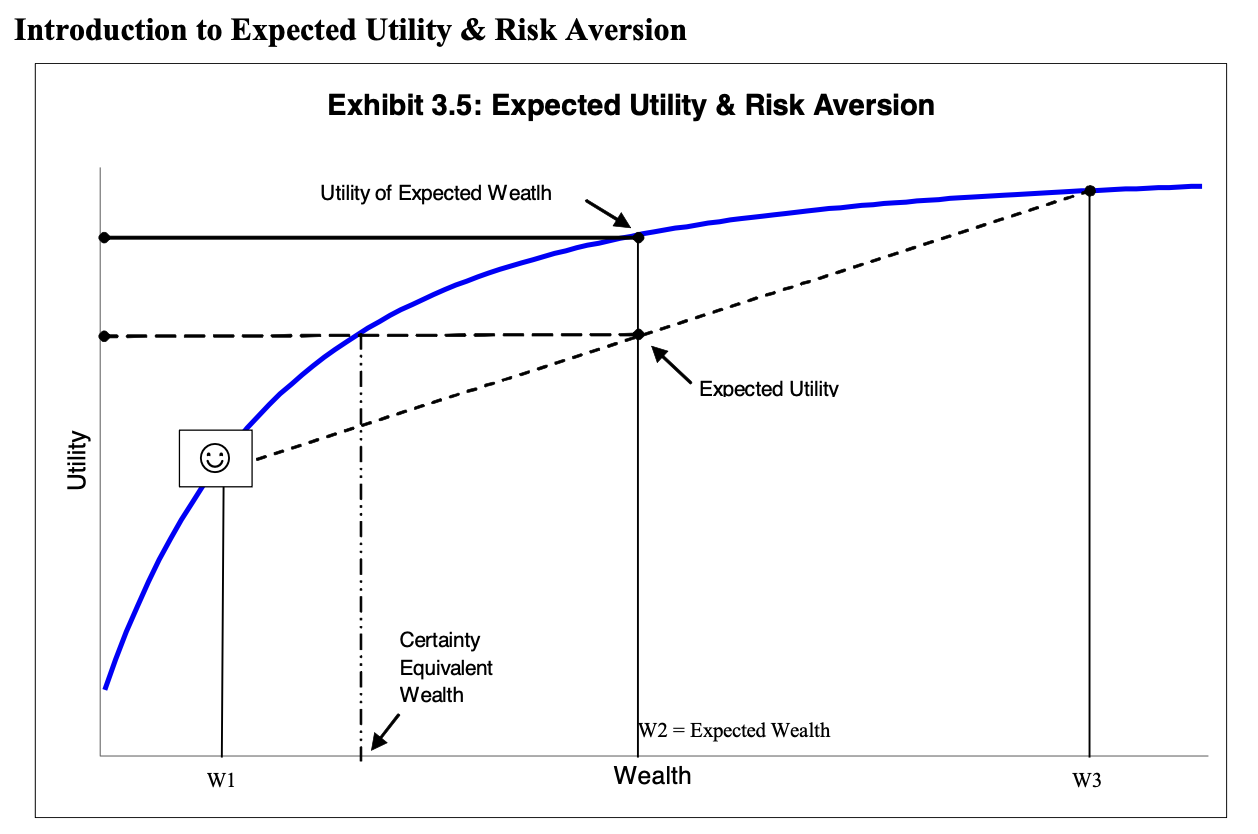

Expected utility of wealth is a measure of how much satisfaction a person expects to get from their wealth, given the uncertainty about future events. It is calculated by taking the weighted average of the utilities of all possible wealth levels,with the weights being assigned by the probabilities of those wealth levels occurring.

Utility of expected wealth is a measure of how much satisfaction a person gets from the expectation of having a certain amount of wealth, regardless of the uncertainty about future events. It is calculated by taking the utility of the expected wealth level.

The key difference between the two concepts is that expected utility of wealth takes into account the uncertainty about future events, while utility of expected wealth does not.

For example, consider a person who is deciding whether to invest in a risky asset. The risky asset has a 50% chance of returning $100 and a 50% chance of returning $0. The person's utility function for wealth is such that they get a utility of 10 from having $100 and a utility of 0 from having $0.

The expected utility of wealth for the risky asset is:

(0.5 * 10) + (0.5 * 0) = 5

This means that the person expects to get a utility of 5 from investing in the risky asset.

The utility of expected wealth for the risky asset is simply the utility of the expected wealth level, which is $50.

This means that the person gets a utility of 50 from the expectation of having $50, regardless of whether the asset actually returns $100 or $0.

It is important to note that expected utility theory predicts that people will choose the option with the highest expected utility. However, there is evidence that people do not always do this in practice.

For example, people often choose safer options over riskier options, even when the expected utility of the riskier option is higher. This is because people are averse to risk.

The difference between expected utility of wealth and utility of expected wealth can be explained by the fact that people are risk averse. They value the certainty of having a certain amount of wealth more than the uncertainty of having a higher possible wealth level.

As a result, people are often willing to give up some expected utility in order to reduce their risk.

This is the end of this posting and I hope this will be informative.

'경제(Economics) & 금융(Finance)' 카테고리의 다른 글

| 주담대? 주택담보대출 이해하기!(LTV, DTI, DSR 그게 뭐야?) (30) | 2023.10.27 |

|---|---|

| 전세자금 퇴거 대출 정의, 조건(한도, 금리, 필요서류) 정리! 전세금 반환대출! (15) | 2023.10.26 |

| Initial Growth Rate와 Second Growth Rate의 해석 (4) | 2023.10.26 |

| Debt Service에 대한 해석 및 의미 (2) | 2023.10.26 |

| Book Value와 Market Value의 차이점 (4) | 2023.10.20 |