Hi everyone, this is Min and I am writing this post to introduce the meaning of equity valuation and firm valuation in financial model.

Equity valuation is the process of determining the value of a company's equity, which is the portion of the company that is owned by shareholders. Equity valuation is important for a number of reasons, including:

- To make informed investment decisions

- To set a fair price for a company's stock in the event of a merger or acquisition

- To assess the value of a company for tax purposes

Firm valuation is the process of determining the value of an entire company, including its equity and debt. Firm valuation is important for a number of reasons, including:

- To assess the overall health and value of a company

- To make informed capital budgeting decisions

- To set a fair price for a company in the event of a sale

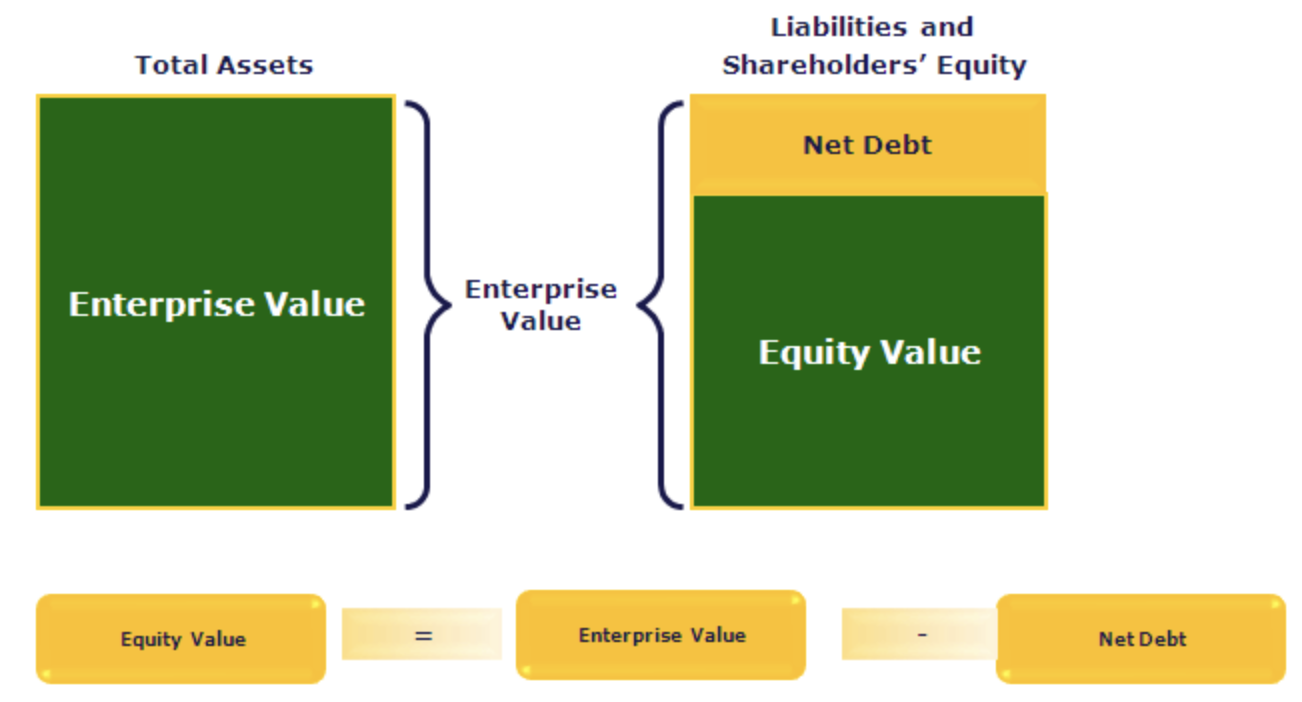

Key differences between equity valuation and firm valuation:

- Scope: Equity valuation focuses on the value of a company's equity, while firm valuation focuses on the value of the entire company.

- Cash flows: Equity valuation considers the cash flows that will be available to shareholders after debt payments have been made. Firm valuation considers the cash flows that will be available to all stakeholders, including shareholders and debt holders.

- Discount rate: Equity valuation uses the cost of equity as the discount rate. Firm valuation uses the weighted average cost of capital (WACC) as the discount rate. The WACC is a combination of the cost of equity and the cost of debt, weighted by the company's capital structure.

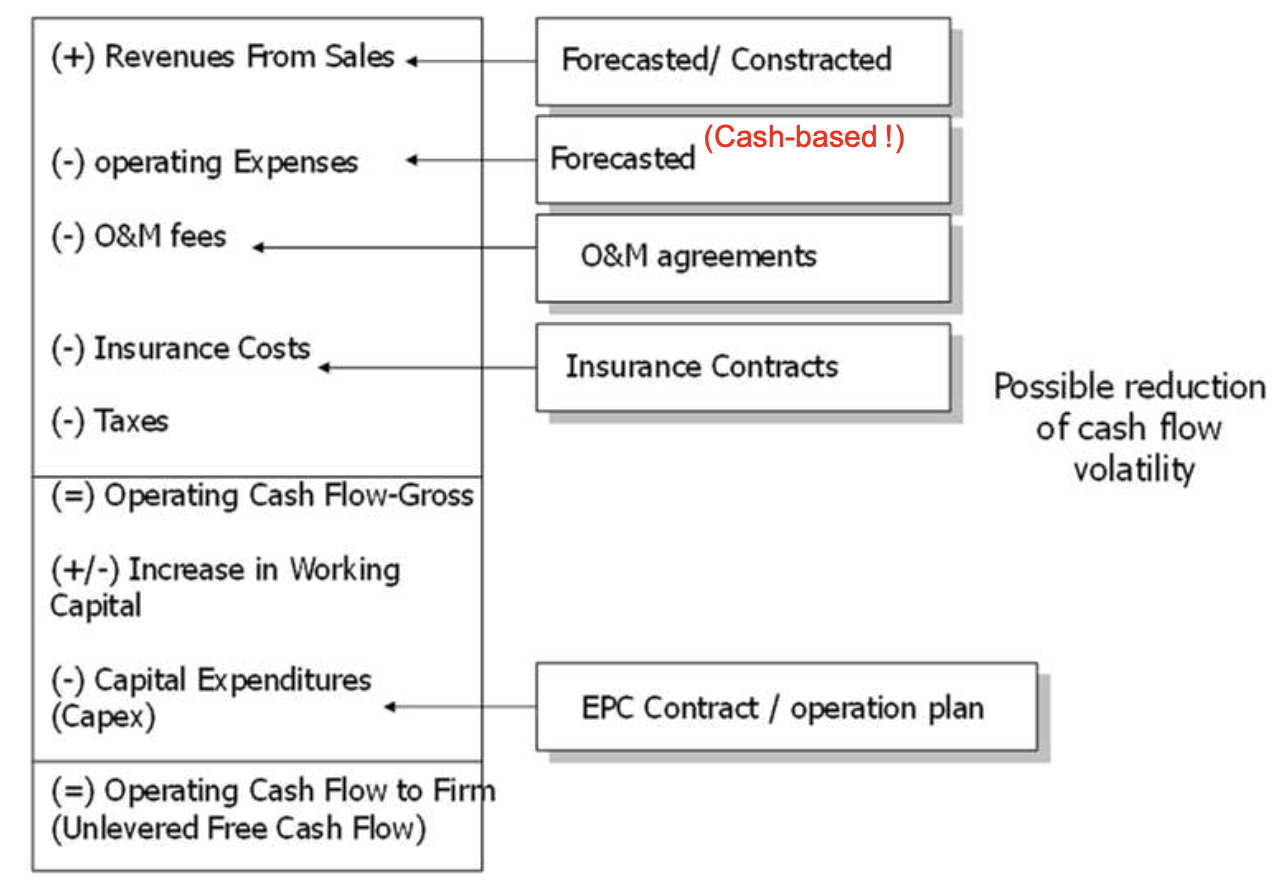

This is the overview of Free cash flow diagram.

Which type of valuation is more appropriate?

The appropriate type of valuation depends on the specific purpose of the valuation. For example, if an investor is considering buying shares of a company, equity valuation would be more appropriate. If a company is considering selling itself, firm valuation would be more appropriate.

Here is an example of how equity valuation and firm valuation can be used in different situations:

- An investment firm is considering buying shares of a technology company. The firm uses equity valuation to determine the value of the company's equity and to assess whether the stock is undervalued or overvalued.

- A private equity firm is considering acquiring a manufacturing company. The firm uses firm valuation to determine the overall value of the company and to assess whether it is worth acquiring.

- A public company is considering selling itself to another company. The company uses firm valuation to determine its asking price.

Both equity valuation and firm valuation are important tools for investors and businesses alike. By understanding the key differences between the two types of valuation, investors can make more informed investment decisions and businesses can make more informed strategic decisions.

I hope this information is helpful for your further research and sturdy.

'004. 잡동사니(Bits and Pieces)' 카테고리의 다른 글

| Discount rate(할인율) from nominal(명목) terms and real(실질) terms에 대한 이해 그리고 분석 (10) | 2023.11.02 |

|---|---|

| DCF가 뭐지? 현금흐름 할인법(DCF)에 대한 해석 (4) | 2023.11.02 |

| 월세/매매 복비 얼마? 부동산 중개 수수료 계산 방법 (5) | 2023.10.30 |

| 전청조 여성? 남현희 전청조 사건 요약 (4) | 2023.10.30 |

| 주담대? 주택담보대출 이해하기!(LTV, DTI, DSR 그게 뭐야?) (31) | 2023.10.27 |